-

Index Fund will do ?

Over the years I have been a big fan of Index Funds and the list of video by Varun Malhotra explain them beautifully ! Varun Malhotra is a seasoned Indian investment educator, alumnus of IIM‑Ahmedabad and Washington University (USA), and Director at EIFS — Edge Institute for Financial Studies. With nearly…

-

Dwarka Rising: Reclaiming India’s History from Myth to Reality

Dwarka – Krishna’s Sacred City Lost to the Sea Dwarka, the legendary city of Lord Krishna, has captivated Indian imagination for millennia. Ancient texts describe Dwarka as a golden metropolis founded by Krishna on India’s western coast, filled with opulent palaces and bustling harbors . According to the Mahabharata, this…

-

Distributed Quantum Computing

The Magic of Quantum Entanglement: A Tale of Two Dice 🎲✨ Imagine you have two special dice, unlike any regular dice you’ve ever seen. These dice are magically linked in a way that defies common sense. You and your best friend each take one—one of you stays on Earth while…

-

Lump Sum vs. INR Cost Averaging

Lump Sum vs. INR Cost Averaging: Where Should You Invest—Arbitrage Mutual Funds or Nifty 100 Index Funds? When it comes to investing, especially in equity markets, two popular strategies are lump sum investing and INR cost averaging (also known as systematic investing). For Indian investors looking at mutual funds, the…

-

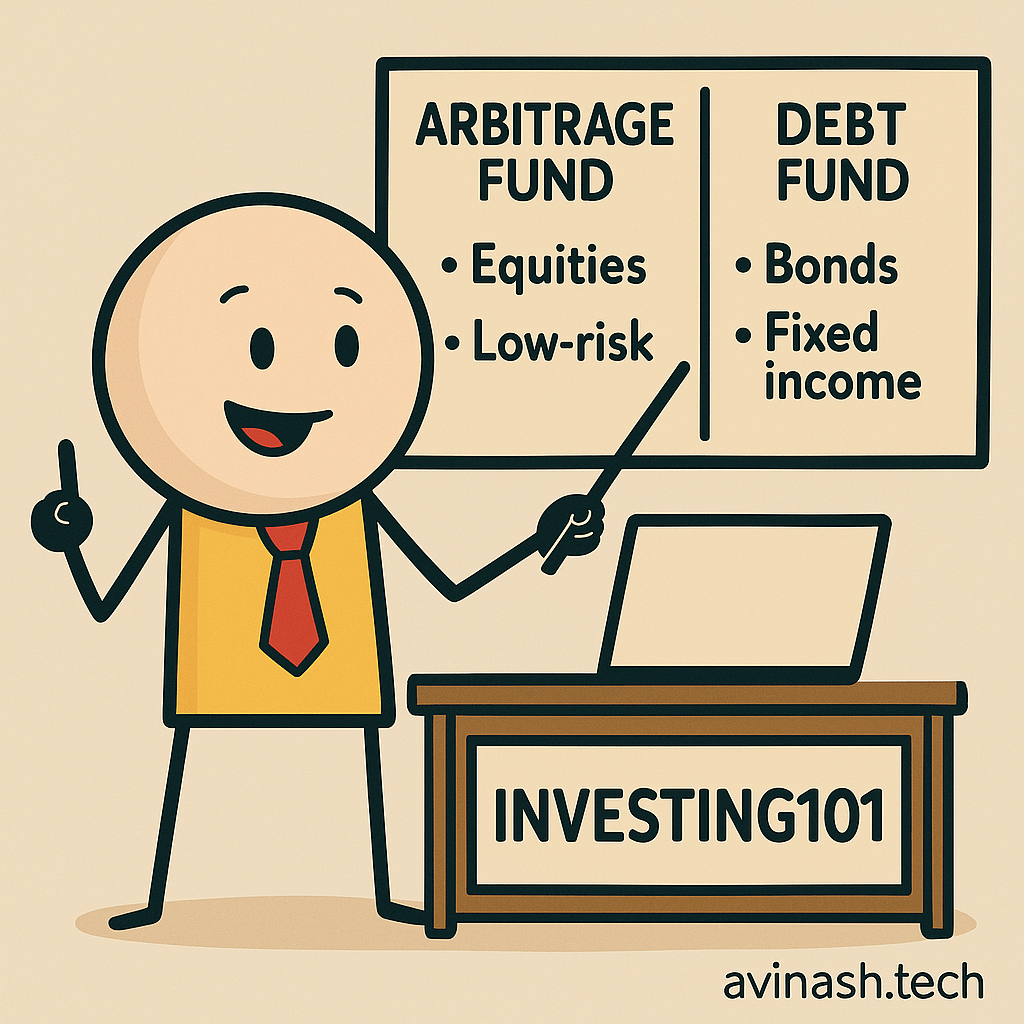

Arbitrage Funds vs. Debt Funds: A Tax-Efficient Investment Strategy for the 30% Tax Slab

Introduction For investors in the 30% tax bracket, every percentage point matters when it comes to net returns. While debt funds have been a traditional choice for conservative investors, arbitrage funds offer a potentially more tax-efficient alternative. This article delves into whether investing in arbitrage funds makes financial sense compared…

-

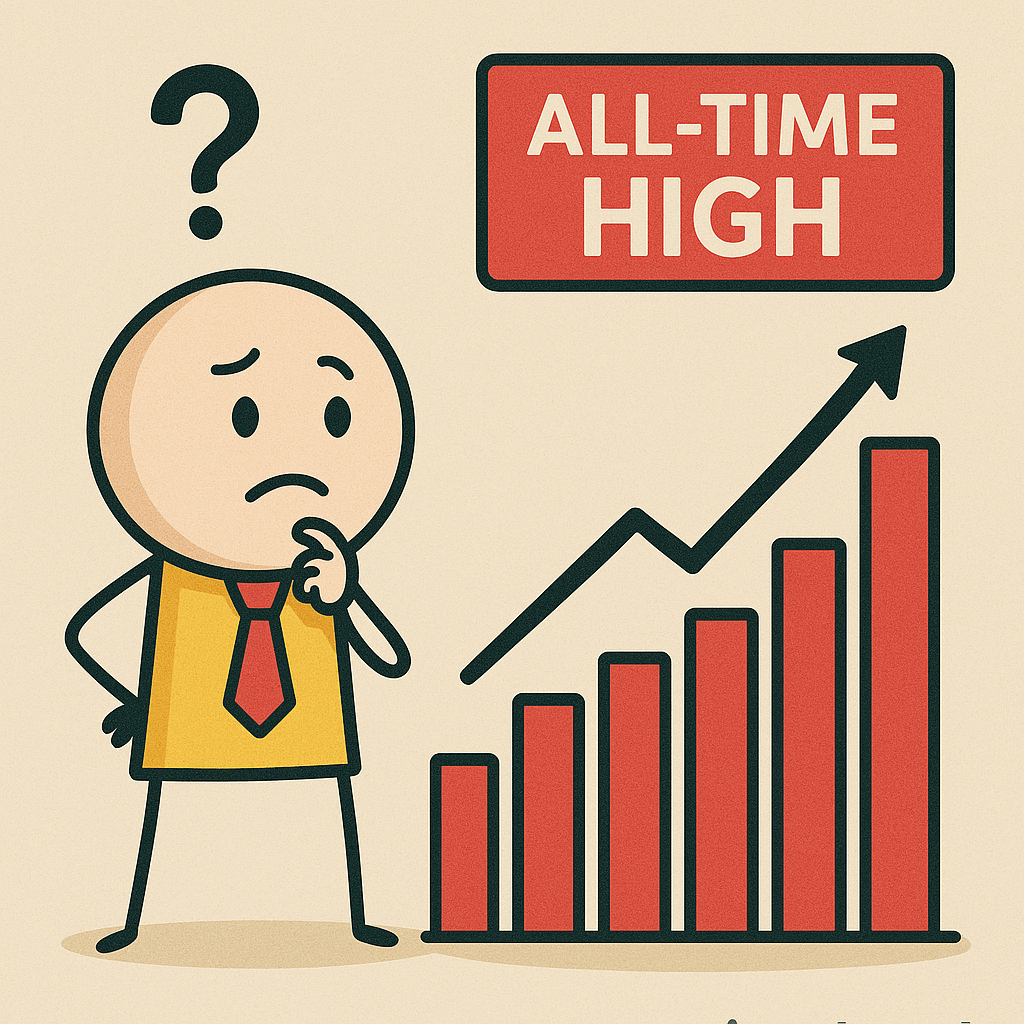

Should you invest in an all time high market ?

If you plan to invest in an index fund like Nifty 100 Direct, the decision between doing a Systematic Transfer Plan (STP) from a short-term fund (like arbitrage or ultra-short-term debt fund) or making a lump sum investment depends on a few key factors: As of September 2024, the Indian…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.