Before we dive deep into the world of Index Funds and why it’s one of the best investment strategies for any sane Investor. Let us first understand the Indices available in Indian Market today.

There are 2 Exchanges available in Indian Stock Market as of 2018.

| BSE | NSE |

|---|---|

| Established in 1875 | Established in 1992 |

| Asia’s first stock exchange. | — |

| Worlds 10th largest exchange | Worlds 11th largest exchange |

| Overall market cap of 2.3 trillion USD as of April 2018. | Overall market cap of 2.27 trillion USD as of April 2018 |

| Not open to all and needs trading membership | NSE ensured that anyone who was qualified, experienced and met minimum financial requirements was allowed to trade. |

| Contains 30 Top companies of BSE | Contains 50 top companies of NSE |

The stocks trading at the BSE and NSE account for only around 4% of the Indian economy unlike in countries like US where most of the GDP comes from huge corporates.

Barely 1.3% of India’s population invests in the stock market, as compared to 27% in USA and 10% in China as of 2018.

Now lets talk about indices…

A stock index or stock market index is a measurement of a section of the stock market. It is computed from the prices of selected stocks (typically a weighted average). It is a tool used by investors and financial managers to describe the market, and to compare the return on specific investments. – Source : Wikipedia

BSE’s index is called the SENSEX and NSE’s Index is called the NIFTY.

Why is NSE better and Nifty a better choice ?

- NSE needs no membership to participate and is open to all

- Fully automated electronic set up for national level trading

- Nifty is broader set of companies compared to Sensex and hence more diversified.

- More stringent protocols for a company to get listed compared to BSE. As a result lot of bogus companies are kept at bay.

Nifty = NSE + fifty

That’s how the name Nifty was coined

Let us talk more about the Nifty 50 which is a better Index of the two and covers a broader market. Nifty represents the weighted average of 50 Indian company stocks in 12 sectors. At any given time the investor is assured that Nifty will have only the best companies based on their performance and market capitalisation.

Nifty is also called the market benchmark

Index Re-Balancing:

Nifty Index is re-balanced on semi-annual basis. The cut-off date is January 31 and July 31 of each year, i.e. For semi-annual review of indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to market from the date of change.

Nifty is maintained by SEBI. Nifty is also used to see how India is doing in terms of growth. Someone with no investment in Index might feel when it goes down he/she is not effected in any way. That’s not entirely true and in fact it showcases the buying power of a common man as it is closely tied to the GDP of a country.

Investing both in Nifty and Sensex is a bad idea as 30 companies in Sensex are a subset of Nifty

Expense Ratio

The expense ratio of a stock or asset fund is the total percentage of fund assets used for administrative, management, advertising , and all other expenses. An expense ratio of 1% per annum means that each year 1% of the fund’s total assets will be used to cover expenses. The expense ratio does not include sales loads or brokerage commissions. Read more…

Tracking Error

Tracking error is the difference between a portfolio’s returns and the benchmark or index it was meant to mimic or beat. Tracking error is sometimes called active risk.

12 sectors from which companies are selected

The sectors are well diversified and as an investor you can be rest assured to buy a piece of business in every sector in India.

When you buy a share understand that you are buying part of the business and trust that it will make you rich on a longer run. Never see it as a vehicle for Short-Term gains. Only invest money that you will not need for say the next 15-20 years. There is no fast lane to make money in Stock Market as its a zero sum game.

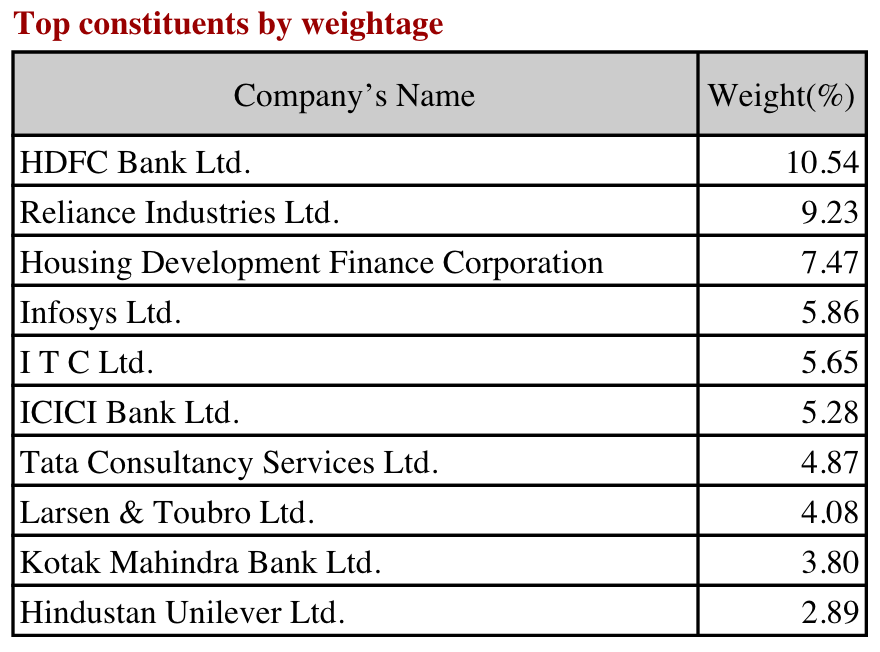

First 10 companies part of Nifty as of November 2018

Only the top 50 best companies in the selected 12 sectors are listed at any given time in Nifty. When a company under performs, it automatically drops out of Nifty and the next contender enters the list.

A companies share price may tank by 10-20% when it drops out of the Nifty or Sensex. This is a litmus test for a company to force them to get their act together !

If one invests in Nifty, 50% of the amount goes into top 10 companies in the list and the remaining 50% goes into next 40 companies. All this happens without having to worry about the distribution of capital by the investor.

Example : If you were to invest 1000 INR in Nifty 50 Index Fund today , 500 INR would go into the above 10 companies based on the weightage. That is , 10.54% of 500 = 52.7 INR would be invested in HDFC Bank Ltd.

To understand why Index Fund is a better choice for a long term investor!! See posts Index Fund Sahi Hai Part 1 and Part 2

“Sahi Hai” means correct choice in Hindi 🙂

Please read the disclaimer carefully before making any investment based on the articles published on this Blog !!

4 responses to “What’s an Index Fund”

[…] covered what are Index Funds in detail earlier. Let’s see why Index Fund is a better choice if you are planning to invest […]

LikeLike

[…] in Index Funds ( Some are not even such a Passive form of investment exists in the form of Index Fund […]

LikeLike

[…] Funds can be good only when invested in a low fee passively managed Fund. Read more about Index Fund, Expense Ratio , Index Fund Sahi hai – Part1 and […]

LikeLike

[…] But lets not get carried away and assume we will get 12% over the next 20 years. Read more about Index Fund, Expense Ratio , Index Fund Sahi hai – Part1 and […]

LikeLike