“Active Passive managed Fund Sahi Hai !!”

We covered what are Index Funds in detail earlier. Let’s see why Index Fund is a better choice if you are planning to invest in Mutual Fund.

Indian market is growing at an astronomical rate. But none can predict which sector in India will outrank the other. For a know nothing investor it’s a better bet to diversify and invest in all the sectors available.

The report above states that in next decade or 2 , India has the top 10 fastest growing cities in the world in terms of GDP. Don’t you as an investor want to be part of this glorious ride to prosperity ?!

We will try to debunk some of the common arguments people give when asked “Why are they not investing in an Index Fund?”.

“Sahi Hai” means correct choice in Hindi 🙂

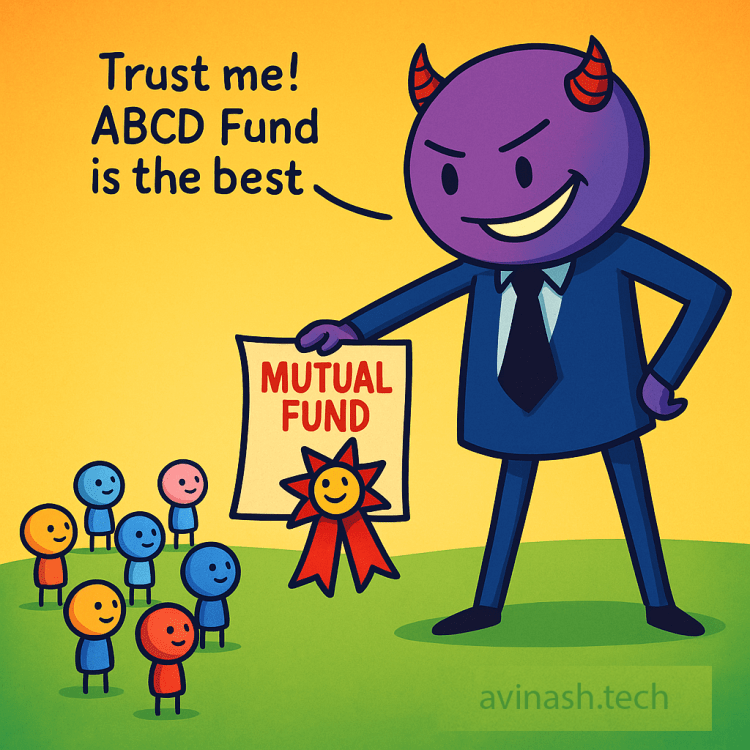

Case 1 : My Financial Advisor never speaks about it !

Financial Advisors get a commission from the Fund Houses for onboarding you to a Regular Fund. They also charge extra for suggesting you such a fund. A win win situation for them being a double Agent. Advisors are only worried about commission and these commissions that look small on paper can eat up as much as 45% of your total returns on a longer run! They would always push you towards a Regular Mutual Fund which has twice the fee compared to that of a Direct Mutual Fund. ( See Mutual Fund 101 )

A Direct Fund can be bought from Mutual Fund Houses using a simple KYC document.

For Example: ABCD bank will offer only ABCD BLUECHIP funds (Regular) even if those funds are sold by their Sister concern ABCD Securities. ABCD Securities will pay a commission to the Advisors of ABCD Bank. Such is the state of Mutual Fund in India. I recently met with a Branch Manager and when asked why they dont sell Direct Funds , he shut me off and diverted the topic :D.

Everyone is doing an SIP but hardly any one is happy with the returns they get. Only 51% investors stay more than a year in Mutual Fund. They either switch to a new shiny one giving more returns ( which will cost 3% change fee) or just stop investing feeling cheated as their dreams of becoming crorepati looked grim.

Stay away from these Financial Advisors who are nothing but leeches in disguise. They will never suggest an Index Fund as they get ZERO commission for it. Index Funds are passively managed fund with Fee as little as 0.2% , all they do is mimic the market. No Advisor or Fund Manager has much work to do!

There are very few Fiduciaries in India and most Financial Advisors will hang someone out to dry !

Just stay away from these leeches !

Case 2 : Why not Actively Managed Fund that give far better returns ?

Financial Freedom can be achieved only when money compounds on a longer run. If we are focused on Short-Term returns other Mutual Fund’s may perform better , but given the Fee and Tax implications even Short-Term Mutual funds have not been able to beat the Market Return.

Market Return usually is the Index – Sensex or Nifty ( See Index Fund )

A well know study has show that “Any Monkey can beat the market”.

What is all this monkey business?

It started in 1973 when Princeton University professor Burton Malkiel claimed in his bestselling book, A Random Walk Down Wall Street, that “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.” .

“Malkiel was wrong,” stated Rob Arnott, CEO of Research Affiliates, while speaking at the IMN Global Indexing and ETFs conference earlier this month. “The monkeys have done a much better job than both the experts and the stock market.”

– Source : https://www.forbes.com/sites/rickferri/2012/12/20/any-monkey-can-beat-the-market

On a longer run only 4% of Fund managers can beat the index/market. So why pay a fee to under-perform and help plan your Advisors Financial Freedom instead of yours 😉

Warren Buffet in one of his Shareholder meetings had openly suggested that Fund Managers take exorbitant Fees which their Funds Performance could not justify. This got lot of Hedge Fund Managers furious and led to the Famous 1 Million Dollar Bet. Protégé Partners LLC accepted, and the two parties placed a million-dollar bet. To keep it fair the Hedge Fund Managers were allowed to create 5 Funds and their cumulative return was to beat the Index Fund !

Hedge Fund Managers have far more power than that of Mutual Fund. Hedge Fund Managers can Short the market , sell under performing assets and can invest anywhere they want to.

The bet began in 2007 and by 2016 the Hedge fund Manager’s had lost handsomely !! Hedge Fund average was 22% while that of Index Fund was a whopping 85%.

The Million Dollar won in the above bet was given out in charity by Buffet.

Warren Buffet after his death plans to donate most of his wealth and put the remaining to a passively managed Fund such as an Index Fund. Having gained his wealth from stocks, Buffett has said he believes the value of his estate would be best maintained using the stock indexes.

We will discuss more such cases in the next post…

Hope you like the post. Do comment and share it with your friends and family!

Please read the disclaimer carefully before making any investment based on the articles published on this Blog !!

5 responses to “Index Fund Sahi Hai – part1”

Spot on advice! The best thing about index funds is that its set it and forget it. No finance knowledge required to beat most of the active investors in the market!

LikeLike

[…] an earlier Article we covered some of the reasons people give for not investing in Index Funds ( Some are not even […]

LikeLike

[…] fee passively managed Fund. Read more about Index Fund, Expense Ratio , Index Fund Sahi hai – Part1 and […]

LikeLike

[…] 12% over the next 20 years. Read more about Index Fund, Expense Ratio , Index Fund Sahi hai – Part1 and […]

LikeLike

[…] why Index Fund is the best choice for any long term investor !! See posts Index Fund Sahi Hai Part 1 and Part […]

LikeLike