Over the years ( 15 to be precise), I have realized it’s not that hard to build your Freedom Fund in India. I should have started way earlier (probably when I was in school 😉 ) , but like we always say, better late than never.

I would love to share with the younger generation on how to get to your Freedom Fund. I am not stating the non-millennial’s have just lost the battle, its just that for non-millennial the 20K rule will have to be doubled.( probably a 20K x 2 rule?).

Freedom Fund : An ideal sum of money that will help you reach a state of Financial Freedom where you will never have to work for money. Money will work for you.

Why should one think about retirement so early?

It’s very hard for someone in their 20’s to start thinking about retirement. Most of the older generation in India have deprived themselves of a solid retirement plan. They are so dependent on pensions and their children for all financial needs. Some even retired way early thinking they had their entire Freedom Fund ready !

This should not be the case going forward for us. Why depend on our kids when its our duty to build a retirement corpus that will help lead a life of dignity and freedom?

Inflation alone will eat up half of your savings if not invested wisely. Don’t you desire doing what makes you happy? Travel the world , spend quality time with your loved one’s , have peaceful/healthy mind… All this can be achieved if you start planning early.

Imagine by age 45, having a Freedom Fund earning for you even when asleep. You will never have to do the boring 9-5 job and Work on what you are passionate about !

How much would one need in their Freedom Fund ( FF )?

The FF numbers are just a hypothesis from the books I have read and the general consensus is as follows:

- Find your monthly Expense ( add up rent, food, clothing, entertainment , etc.. )

- Multiply that by 12 ( to find the yearly expense )

- Multiply it by 25-30 ( Lets take 30, as inflation in India is at a higher side)

Freedom Fund to retire at age X = Yearly Expense * ( 1000 / X)

Example: if one plans to retire at 30 at yearly expense at age 30 ( say 5 Lakhs) , FF required would be 5,00,000 * ( 1000 / 30 ) = 1.67 Crores

Example: If your monthly expense is say 40,000 , yearly would be 40,000 x 12 = 4,80,000. So the final Freedom Fund would amount to 4,80,000 x 30 = 1,44,00,000 ( 1.44 Cr ). The 1.44 Cr should be in Investment’s that are generating steady stream of returns for remainder of your life!

As a newbie living on an monthly expense of 40K is borderline case of being spendthrift 😉 . I would suggest curb down on lavish spending’s.

If you are in debt already, just start living like your kidneys are in a garage sale and you need to buy them back asap! Curd-rice and pickle party till the kidneys are back.

1.44 Crore looks a lot for most of us ( looking at our current investment portfolio, it does 😉 )… Now lets see if its really that hard to achieve.

Drum roll’s…. Here comes the 20K Rule !!!

What if you could keep just 20K aside and create your Freedom Fund? For some of us 20K might be a big amount, but if we really try and cut down on all the unnecessary expenditures, 20K is nothing !

Lets start spending investing our 20K per month wisely, shall we?

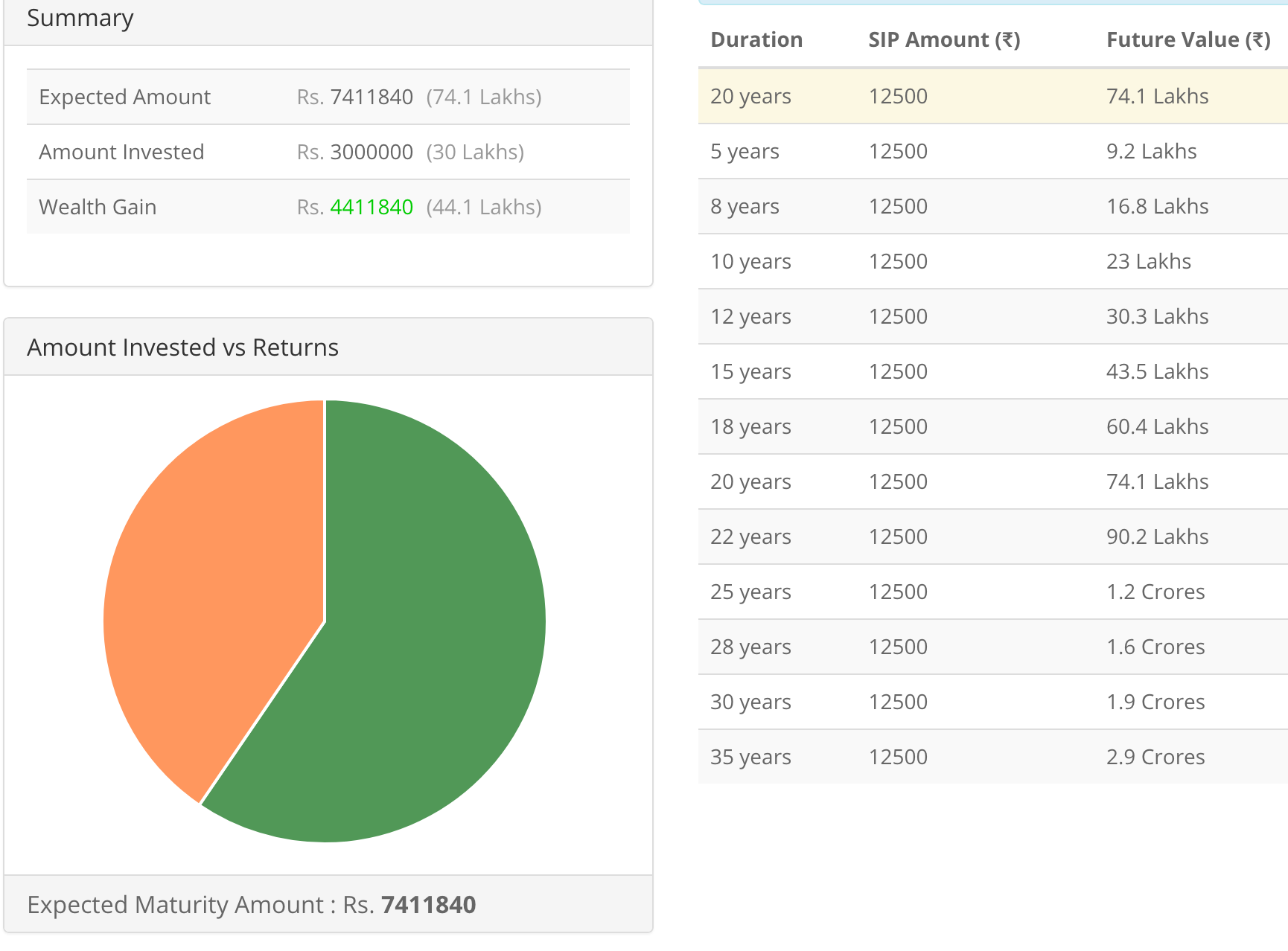

₹ 12,500/- out of the ₹ 20,000/- (20K) goes into a safe Debt fund like PPF ( Public Provident Fund ). Its backed by Government of India and is one of the safest investments around. Let us see in 20 years what wonders a neglected scheme like PPF can do to your Investment !

Investing 12500 per month in PPF at 8% compounded for 20 years yields a TAX FREE Return of 74Lakhs !!!

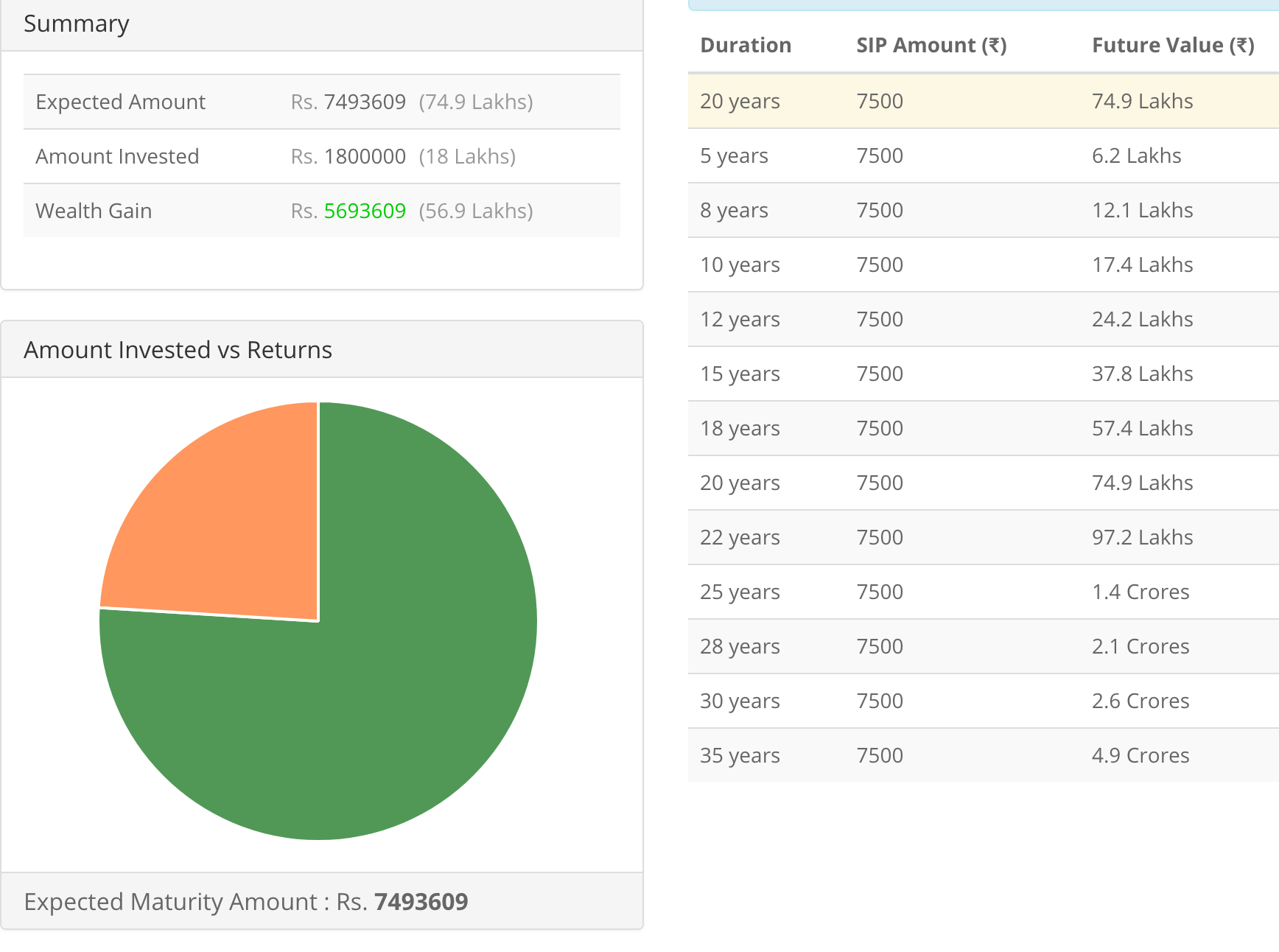

Now we are left with 7,500/-. The next best option for better returns is to invest in growing Indian Economy through a passively managed Mutual Fund like Nifty 50 Index Fund.

Till date Nifty has given an average return of 12%. Most economists believe that in next 25 years Indian Market will perform way better !! So expect more than 12%. But lets not get carried away and assume we will get 12% over the next 20 years. Read more about Index Fund, Expense Ratio , Index Fund Sahi hai – Part1 and Part2.

If one invests in a Low Fee passively managed Mutual Fund like Index Fund which may give a return of 12% compounded. What would it look like ?

SIP of 7500/- in Nifty 50 at 12% for 20 years. Return of 75L! ( You could continue to invest and generate more returns, those Future value numbers are crazy 😛 ). All this is possible only because of the Power of Compounding!

Now if we add up the returns from PPF and Index Fund investments it would be a mind boggling 1.49 Crores!!! Comfortably hit our Freedom Fund goals for a monthly expense of 40,000/- INR. And all this without having to break a sweat.

We would increase our contribution of 7500/- as we grow in our career with a hike of 6-8% in salary.If the contribution to Nifty 50 Index Fund gradually is increased at ~7% we would be looking at 1.2 Cr in returns over a period of 20 years!!

A combined return of ( PPF + Nifty Index )= 0.74Cr + 1.2Cr = 1.94Cr (~2 Crores) !!!

Forget all the Fund Advisors, their exorbitant Fees, constant tracking of the Stock Market. Just put your money and relax. Do something more useful with your time than to worry about investment!

Starting this year ( 2018 ), a fixed Capital gain tax of 10% is levied during withdrawal of your Fund money after 1 year, this is independent of the Tax Slab you are in.. See Compound Interest Article for Tax free investments.

With career growth, you will be able to add more than just 20K per month towards your Freedom Fund. 20K Rule can be applied to everyone in your family and not just you. So act wisely and multiply the 20K rule . Speak with your Spouse , plan to create a 20K rule even for your kids!

Max out the investment towards PPF ( 12500/- per month) and put the remaining in a low cost Index Fund. If you are still left with more surplus funds , feel free to gamble with Stock market and Mutual Funds :).

Your Freedom Fund could later even sponsor a dream Vacation in Europe or buy you that Dream Home! All it needs is discipline.

I just coined the 20K rule to show how easy it is to build substantial wealth over a period of 20 years. Feel free to adjust this based on their current income( I would still say get to 20K rule somehow). Create your own rule, could be 30K, 40K, 50K rule … but start with 20K rule immediately if you are new to investing.

If you and your spouse enroll in 20K rule , in 20 years a extremely healthy Freedom Fund of 4 Crores can be built.

No country in the world can promise such a bright future for your investment. Make use of it and Happy Investing !

Please read the disclaimer carefully before making any investment based on the articles published on this Blog !!

2 responses to “The 20K rule to Financial Freedom”

[…] prices are exorbitant and the Housing bubble is waiting to burst just round the corner. With just half the amount invested smartly ,you can retire with a lot more money and happiness. Having money to spend on things you need is […]

LikeLike

[…] on the earlier post talking about 20K rule to build a Freedom Fund ( FF ) , the investment schemes have been divided into A , B and C […]

LikeLike