Most people sleepwalk their financial life…

I’m no exception; I’ve managed to stay afloat largely because I avoided “good” habits (like beedis, cigarettes, alcohol, or gambling) and stuck to the rules my grandfather drilled into me:

• Be frugal in life: If you buy things you don’t need, you’ll end up selling things you do need.

• Invest regularly and save at least 25% of what you earn. Put money into investments first; then spend whatever is left.

• Stay away from get-rich-quick offers—if someone promises more than 10%, pause and think twice!

• Avoid debt like the plague.

These lessons served me well from an early age and still keep me on track and have helped me in accumulating wealth. The only unwelcome side is the inflation steadily eating into it.

The current inflation rate in India is around 7%. ( as of 2024 )

Why is inflation bad ?

Inflation is like a slow puncture in your wallet.

Let’s say your bank savings give you 6% interest, but inflation is at 7%. You’re actually losing 1% every year. It may not look like much, but over 10 years, it adds up. For example, if an apple costs ₹20 today, it might cost ₹40 in the future—so the same money buys you less.

That’s when I realised: I need an investment plan that doesn’t attract heavy taxes and doesn’t require me to track the stock market every day. After all, wealth should grow even when I’m asleep!

But how do you know if you’re truly “awake” when it comes to investing?

- You know that once an investment goes to zero, it’s game over. Money doesn’t grow back from ashes—just like seeds don’t sprout in burnt soil.

- You understand the different ways to invest—like mutual funds, PPF, NPS, index funds—and how they can grow your retirement savings.

- You get the power of compound interest—where your money earns money, and then that money earns more.

- You learn how to legally save taxes by choosing the right investment options under sections like 80C and 10(10D).

- You realize that high risk doesn’t always mean high returns—smart investing is about balance, not gambling.

Being financially “awake” means making your money work for you—consistently, wisely, and without sleepless nights.

We’ll explore these points more deeply in future posts, so don’t be scared of investing. Focus on learning, then pick what suits you best in the long run. After all, once you know the ropes, your money can work for you instead of the other way around.

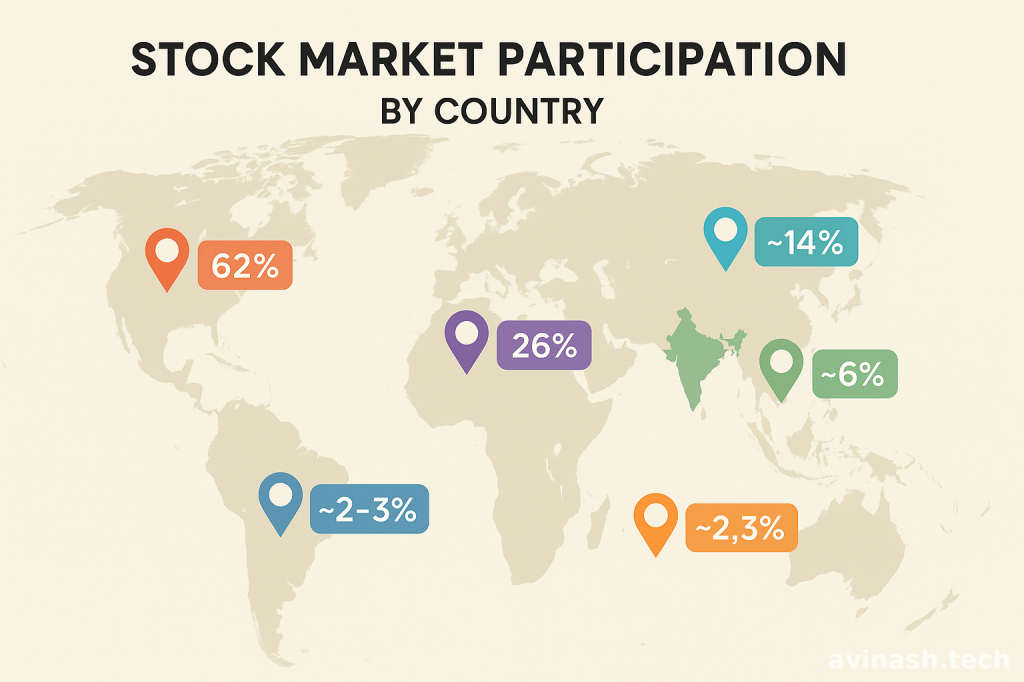

Looking at the info above , Barely 6% of Indians invest in the stock market. With India’s GDP set to reach $10 trillion by 2035, there’s a huge opportunity to ride this growth wave. But stock investing feels unfamiliar to many of us. This series will help uncover the secrets to confidently enter the market!

“Go to bed smarter than when you woke up.”

–CHARLIE MUNGER

Reading books on investing is a surefire way to “wake up,” though many of these books can feel as dry as old toast. In my future posts, I’ll aim to keep it lively and share the key lessons I’ve picked up—both from these books and from long, and sometimes heated, chats with my brother!

Here are a few books you can go through if you still feel you want to get down in the trenches and improve your knowledge !

| Book Title | Author | Brief Description |

|---|---|---|

| The Little Book of Behavioral Investing | James Montier | Describes how psychological biases impact investment decisions and how to avoid them. |

| The Intelligent Investor | Benjamin Graham | Explains value investing principles, risk management, and long-term market analysis. |

| Common Sense on Mutual Funds | John C Bogle | Argues for low-cost, passive index fund investing over actively managed mutual funds. |

| Little Book of Common Sense Investing | John C Bogle | Provides a simple case for using low-cost index funds to achieve investment success. |

| The Dhando Investor | Mohnish Pabrai | Outlines a low-risk, high-uncertainty value investing approach focused on simple businesses. |

| Rich Dad Poor Dad | Robert T. Kiyosaki | Highlights the importance of financial literacy, assets over liabilities, and mindset. |

| Poor Richard’s Almanack | Benjamin Franklin | Contains timeless wisdom on frugality, hard work, and building personal wealth. |

| University of Berkshire Hathaway | Daniel Pecaut & Corey Wrenn | Shares insights and lessons learned from attending Berkshire Hathaway’s annual meetings. |

| The Simple Path to Wealth | J L Collins | Presents a simple, actionable plan for financial independence through index investing. |

| Warren Buffett’s Management Secrets | Mary Buffett & David Clark | Explores the core management and leadership principles used by Warren Buffett. |

| Money Master the Game | Tony Robbins | Provides a step-by-step guide to financial security based on interviews with financial experts. |

| Random Walk Down Wall Street | Burton G. Malkiel | Explains the efficient market hypothesis and advocates for diversified, passive index investing. |

| 13 Steps to Bloody Good Wealth | Ashwin Sanghi | Outlines practical steps and principles for achieving significant financial wealth. |

| Autobiography of a Stock | Manoj Arora | Uses a narrative approach (a stock’s life) to explain stock market concepts. |

| Let’s Talk Money | Monika Halan | Offers straightforward advice on managing personal finances, tailored for an Indian audience. |

| Boglehead’s Guide to Investing | Taylor Larimore, et al. | Details the Boglehead investment philosophy emphasizing simplicity and low-cost index funds. |

| Where Are the Customer’s Yachts? | Fred Schwed | Offers a witty critique of Wall Street practices and the financial industry’s self-interest. |

| Millionaire Next Door | Thomas J. Stanley | Studies the habits and characteristics of unassuming, self-made millionaires. |

Investing is easy and in future posts we will see how. Hang in there and make sure you don’t fall into get quick rich schemes till then :).

Happy Investing! Its your money , don’t let others take control of it !!

Read Next : Warren Buffet Mantra

Please read the disclaimer carefully before making any investment based on the articles published on this Blog !!

One response to “Wake-up and Invest”

[…] Wake-up and Invest – Understand why building a retirement corpus is so important. Wake up ! […]

LikeLike