Why are expense ratios pure evil ?

An expense ratio of 1% per annum means that each year 1% of the fund’s total assets will be used to cover expenses. The expense ratio does not include sales loads or brokerage commissions.Lets see how an expense ratio of just 2% can eat up your returns. Consider a monthly investment of 20,000/- INR for a period of 20 years with 17% compounded returns.

| Investment grows to 4 Crores with the power of compounding ! | Investment down by 1 Crore due to an expense ratio of 2% !!! |

A difference of 1 Crore in returns, with an expense Ratio of just 2%. Just 2%, no longer feels justified, does it?? We may feel, if the returns are 17% , why not pay the Fund Manager the extra 2%? In later chapters, we will understand why the assured returns are never true.

To understand this better, take an example of 3 friends Arjun , Bheem and Chanakya, who at age 25 get together and decide to invest 1,00,000 INR in Mutual Funds. They soon realize, each of their selected funds incur a fee of 3% , 2% and 0.2% respectively. They still go ahead with the investment and plan to get back to it after 30 years.

At age 55, all get together to see how their Mutual Funds have performed over the years. Assuming each of the funds gave the same return, the following results were observed.

- Arjun got a return of (10% – fees of 3% ) = 7,61,225.50

- Bheem got a return of (10% – fees of 2% ) = 10,06,265.69

- Chanakya got a return of (10% – fees of 0.2% ) = 16,52,228.86

Chanakya’s Fund,a clear winner beating Arjun’s fund comfortably, by 2X. Clearly, fee does matter !!!

In the above scenario we took a hypothetical scenario where the market gave us 10%; what if the market remained flat for 10+ years and we still gave a fee of 3%? We would be down by 40% of our investment. So in other words money and risk associated with the investment is on us , while the Fund Manager continues to make money. Isn’t this day light robbery ?

“By giving excessive fees, you are giving up 40% to 60% of your future nest egg”. – John C. Bogle , Creator of Vanguard

THAT WOULD SOMETIME AMOUNT TO WORKING 12 MORE YEARS TO ACHIEVE ONE’S FINANCIAL FREEDOM !!

What should one look for while selecting Mutual Funds ?

- Always pick Direct over Regular

- Always choose a Mutual Fund with least Expense Ratio

- Never go by past performance of a Mutual Fund. Nobody can predict the market.

The best bet for a Know Nothing Investor ? Invest in an Index Fund that matches the returns of a Market. Why ?

- Has the least expense ratio ( < 0.5 % ) .

- No Exit load ( Entry load recently banned by SEBI for all MF’s )

- Compounded Annual Growth Rate for Index Fund has been 12% to date. Way better than Fixed Deposit which gives 7% + TAX.

- No/Least Operating cost.

- Investment horizon 15+ years. Slow and steady wins the race

We will understand more about Index Funds, and why it is the best option for anyone, not a novice investor. Couple of years back, huge campaigns on Television started appearing “Mutual Fund Sahi Hai” was the slogan. It was so rampant that every commercial break during a cricket match being watched by millions would have it.

Indian Mutual Funds have currently about 2.57 crore (25.7 million) SIP accounts through which investors regularly invest in Indian Mutual Fund schemes – Association Of Mutual Funds in India .

A whopping 76,543 crores was pumped into Indian Stock Market through Mutual Fund SIPS in the year of 2018. This has led to a bubble that is ready to burst. Lets understand why this is a bubble.

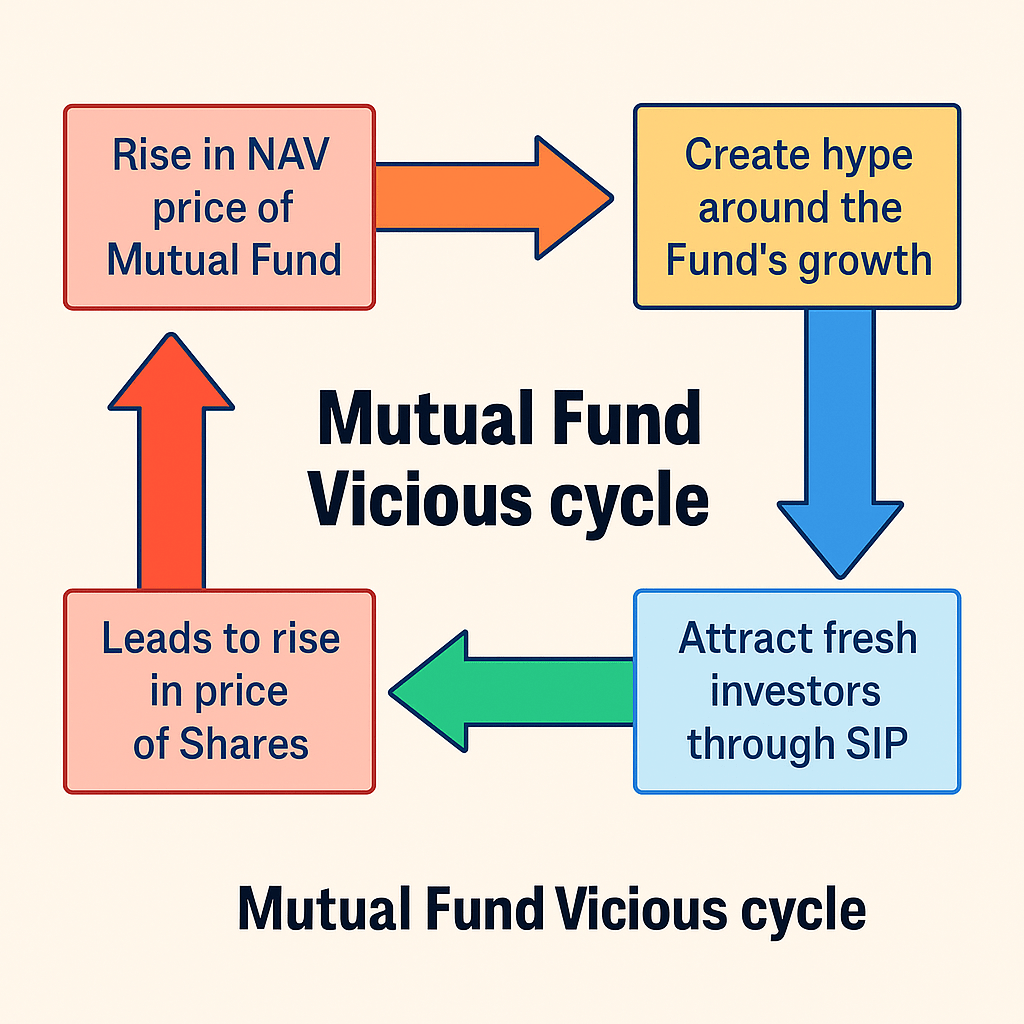

Mutual funds, these days, can even help plan your dream vacation. The investment horizon is sometimes less than 5 years, shortening the wait to go on that expensive vacation. These are nothing but false hopes being fed into a naive investor, making sale of Mutual Fund Schemes a cake walk for most Financial Advisors. We also by now, know how these Advisors get a fat commission for on-boarding a naive investor. As more people join the bandwagon , SIP’s also increase steadily . Starting every month, the SIP’s have to be used by the Fund Manager, to buy shares of stocks that are part of their Schemes Portfolio. This purchase of shares , automatically drives the price of a company’s stock higher, creating an artificial shortage of shares in the pool. The rise in price, then leads to increase in price of NAV of a Mutual Fund. This increase in NAV price , attracts more naive investors into the quicksand of SIP.

A vicious cycle that cannot go on for long. Stock market is a zero sum game, if one Fund Manager is showing profits , another Fund Managers has to show losses !

We all keep hearing “Mutual Fund sahi Hai” ? Is this even true ?

Let’s see how most funds performed compared to the Market when the days are gloomy, shall we?

Less than 50% of the Fund Managers invest in their own funds. Think about it… Lack of confidence in their own ability to beat the market ?! There are a total of 32 schemes out of the top 100, in which fund managers have no investments of their own, and another 18, where the investment is less than Rs 10 lakh. Thus almost 50 percent of these schemes have negligible investment by their own fund managers.

Market here stands for the Market Index. India there are 2 market indices. Nifty and Sensex. An Index of a stock market, helps how the country as a whole is doing. The GDP of a country is directly tied to the market Index. We will understand in detail, about Market Index and related Index Funds in later chapters.

Also at the time of writing this book, market had turned into a bearish cycle. Most Mutual Fund Scheme were yielding a return in negatives. On the other hand, Index or in “the market” gave a return of 7% Compared to what the Mutual Funds curated by the so called Market Experts gave , and that too with an exorbitant expense ratio of ~3%.

Fund houses will proudly justify the 3% Fee being charged in the name of expense ratio as they claim to beat the market comfortably ( which is clearly NOT TRUE ).

On a longer run an expense ratio of just 2% can eat upto 55% of your returns, which is mind boggling ! A fund that generates a negative return of -13% would actually mean a return of -21% as one has lost the +8% return that the market could have given for the same period!! Even a safe Debt fund like PPF would give a healthy return of 8% without any tax levied on the returns.

Index funds have yielded a compounded interest ( CAGR ) of 15% since the day of inception.

Today there are 3000+ mutual funds in India and 90% of them fail to beat the Index. Nobody can predict the market for the next year, month or days. But the fact remains that market will go up on a longer run say 15 years from now for sure.

There is also the dark side !

When talking about Mutual Funds, the investors are always shown a rosy path to Financial Freedom.With Funds giving a return of 25% or more, consistently,over the last decade. This is a classic case of “Survivorship Bias”. What about the funds that were once stars and then when close/shutdown as their numbers were not good?

We will understand Survivorship Bias in detail in the later chapters. Research like these, help us understand the true story behind the world of Mutual Fund, and how easily, a naive investor is being fooled into investing , making them believe , all their investment goals are taken care of.

There are thousands of Mutual Funds, that have been shut down. A quick Google Search will show ,this list ,is nowhere to be found. Fund Houses have a great skill, to bury them too !

Only 3% of Mutual Fund Managers, on a longer run can beat the Index. The game is to generate compounded returns and Index Fund seems to be the only vehicle in the stock market that can do it consistently. I have also found that most banks and firms don’t even list Direct Mutual Fund(MF) and only have Regular MF listed.I plan to cover Regular versus Direct MF in a post soon .Don’t just hand over your hard earned money to a so called advisor. Better hire a monkey if you really think a high cost advisor is needed !!

Read Next: ABC of Index Fund

Please read the disclaimer carefully before making any investment based on the articles published on this Blog !!

3 responses to “Mutual Fund expenses”

[…] explained in my earlier posts , the goal is to choose a fund with the least Expense Ratio ( why ? , read here ) . The Mutual Fund with the least expense ratio as of today is from UTI with an expense ratio as […]

LikeLike

[…] Expense Ratio and Fees – Understand why fees are bad for your returns !! […]

LikeLike

[…] Expense Ratio is one of the purest forms of evil, among the fees levied on the naive mutual Fund investor. A decade back, I was attending one of my favourite cousins’ weddings. My uncle who worked in a bank, proudly spoke about SIP ( Systematic Investment Plan ) and how, as a young investor, should start investing through SIP. SIP is now the most heard investment jargon these days and somehow the solution to all our financial trouble, and the best means to be a Crorepati. But a decade back SIP was new, I did not understand the concept clearly, and my grandad was always weary of the fact that a smart investment could provide more than 10% returns. One of my uncles, bluntly called it a scam and stayed away from it. This led me away from the world of Mutual Fund investments and I am very grateful that I did. Read more about in detail about Expense ratio. […]

LikeLike