Category: Income Tax

-

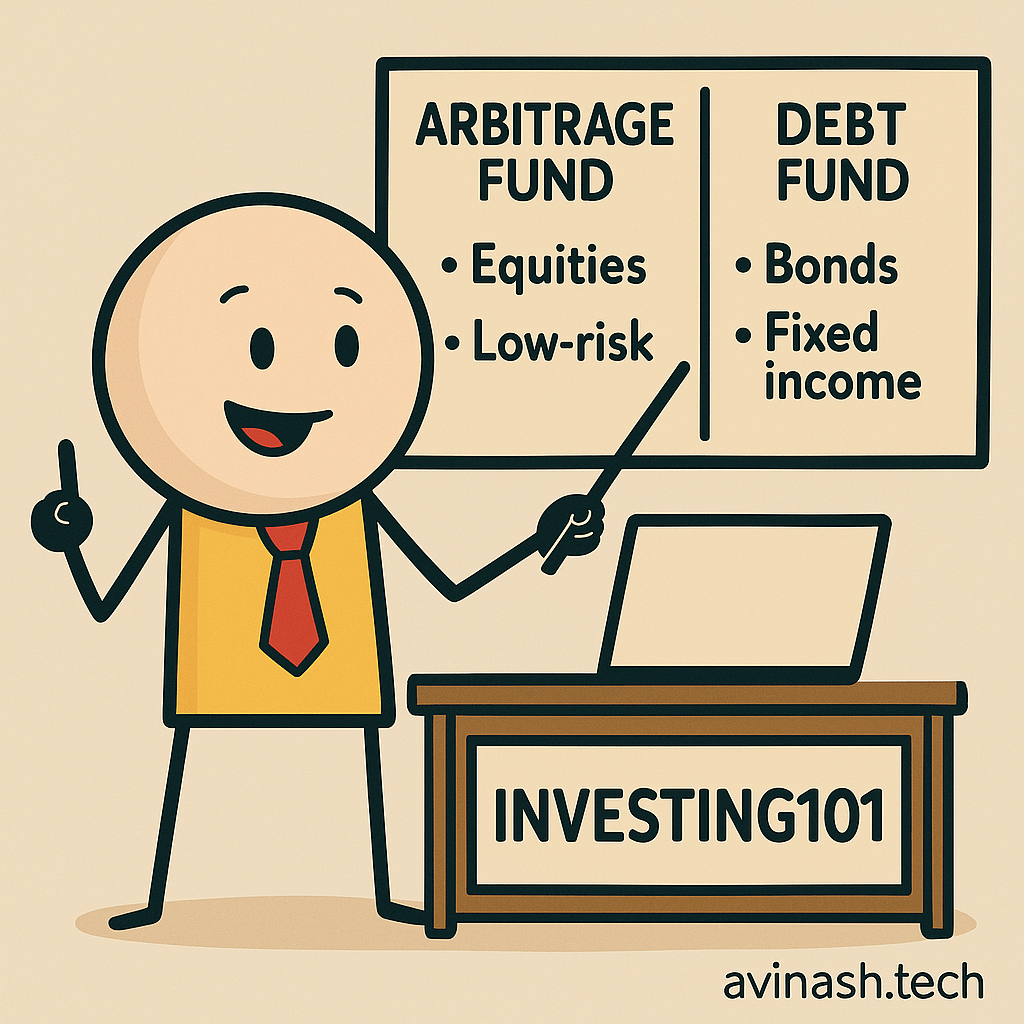

Arbitrage Funds vs. Debt Funds: A Tax-Efficient Investment Strategy for the 30% Tax Slab

Introduction For investors in the 30% tax bracket, every percentage point matters when it comes to net returns. While debt funds have been a traditional choice for conservative investors, arbitrage funds offer a potentially more tax-efficient alternative. This article delves into whether investing in arbitrage funds makes financial sense compared…

-

Quick Info

Income tax as on Dec, 2020 Income Tax slab for resident Individual who is less than 60 years of age Taxable Income Slab Income Tax Rate & Cess Up to Rs. 2.5 Lakh NIL Rs. 2,50,001 to Rs. 5,00,000 5% of (Total Income minus Rs. 2,50,000) Rs. 5,00,001 to Rs.…

-

Meet retirement goals

Learn, how one can build a retirement corpus using a combination of Compounding and Tax saving on capital gains. Lets discuss the investment vehicles in details.

-

Avoid Income Tax

Income Tax is one thing that everyone fears about , but least understood.